Egypt-based, Africa-focused

Bring the right value

Over 35 companies

We partner with bold and resilient founders

building transformative companies

Empowering entrepreneurs to improve people’s lives at scale

More than $825M invested in our portfolio companies

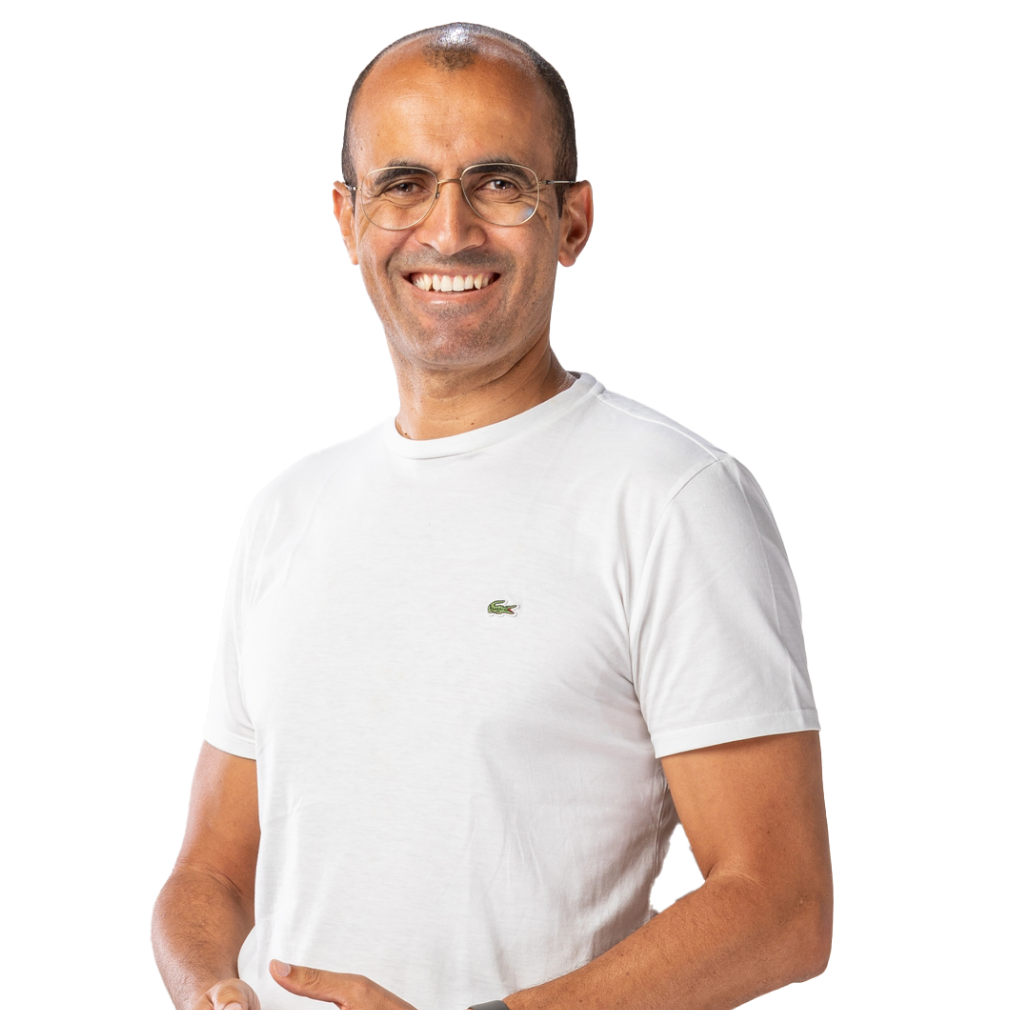

Karim is a technology veteran with deep experience in product and innovation management and rapid business growth and scaling – particularly in the healthcare and financial services markets. Karim has been an active investor and mentor to a number of technology businesses in Egypt and the US. He is founder and Chairman of D-Kimia Diagnostic Solutions developing fast, affordable, and accurate medical diagnostics using nano-technology and focused on controlling the Hepatitis C epidemic in Egypt and globally.

Karim has served on the board of D-Kimia, Integreight, Shezlong.com, Prognos.ai, and Simplex Arabia CNC Solutions. He is also Chairman of the entrepreneurship committee of the Egyptian National Competitiveness Council, a mentor to high impact entrepreneurs through the Endeavor network, and a fellow of the Aspen Global Leadership Network.

Previously, Karim was SVP, Products and Engineering at WebMD, Inc., directing product management, technology strategy and engineering. Prior to WebMD, Karim was co-founder and CTO of Riskclick, Inc., a software firm specializing in commercial insurance applications. He also was a senior associate at Booz Allen & Hamilton where he was a member of the Global e-Commerce team.

Karim received his PhD in Information Systems from MIT and a dual BSc in Electrical and Computer Engineering from Carnegie Mellon University.

Tarek Assaad is Managing Partner at Algebra Ventures, Egypt’s leading VC firm. Algebra’s $54M first fund invested in 21 companies including some of Egypt’s most prominent technology startups. Its new $100M fund is actively investing in Egypt and the region.

Prior to Algebra, Tarek was Managing Partner at Ideavelopers where he had been managing $50m of VC investments since 2009 and where he led the fund’s investment in Fawry, the first venture-backed company to go public in Egypt and to become a unicorn.

Tarek started his career as an engineer at Lucent Technologies then as a software developer at SAQQARA Systems, an internet startup in Silicon Valley.

Tarek holds a B.Sc. in Electronics and Communication Engineering from Ain Shams University in Cairo and an MBA from Stanford Graduate School of Business.

Laila joined Algebra Ventures as a General Partner to launch the VC’s second fund in 2021. Over the past three years, Laila Hassan has been actively investing in African companies at Algebra Ventures, backing startups across diverse industries including fintech and mobility. She is also a Venture Partner at 500 Global where she is responsible for 500’s first MENA Fund (500 Falcons). She joined 500 back in 2019 as a Principal to lead the fund’s follow on strategy. Laila has been instrumental in expanding portfolio data gathering as well as analysis efforts from the portfolio. Prior to that, Laila worked with several VC firms across the region such as Middle East Venture Partners in UAE and Algebra Ventures in Egypt where she led transactions and worked with portfolio companies on fundraising and operational enhancements.

Laila was active in the venture capital and startup landscape in Egypt, where she worked as a consultant for several start-up businesses assisting them in developing operational and fundraising schemes. She led investment assessments and provided recommendations to several VCs and family offices in the region. While completing her MBA from London Business School, Laila joined the investment banking division at Morgan Stanley in London as a summer associate, after which she opted to move back to Egypt to pursue a career among the now-thriving startup community. Prior to her postgraduate studies, she worked as an associate at Qalaa Holdings, a regional private equity firm based out of Cairo, where she focused on the alternative energy, oil and gas and glass sectors. She holds a dual undergraduate degree in Business Administration and Law from the American University in Cairo and Cairo University respectively.

Omar is General Partner at Algebra Ventures. He joined Algebra in 2018 as an Associate. He helped execute investments in several rapidly growing companies, including Brimore, Dsquares and POSRocket. In 2020, Omar was promoted to Principal, taking on board responsibilities in portfolio companies and leading new investments. Prior to joining the firm, Omar held an executive role at Yodawy, an online pharmacy and insurance benefits management startup. Earlier in his career, he co-founded and was CEO of Tutorama, a marketplace for peer-to-peer tutoring.

Omar holds a Bachelor of Laws (LL.B.) from the London School of Economics and Political Science and a Master of Laws (LL.M.) from Cornell University.

Ziad Mokhtar is the Co-Founder and CEO of oliv.finance and Founding Partner of Algebra Ventures.

oliv was founded in 2024 and is Egypt’s first digital factoring company. It offers invoice financing services that help small and medium businesses bridge their financing gaps. It is on a mission to grow the reach of factoring services in Egypt by 10x.

Before oliv, Ziad had been one of the leading Venture Capital investors who shaped tech investment in Egypt since 2010. He started his venture capital career at Ideavelopers which managed one of Egypt’s first venture capital funds. Its investments included fawry (acquired), siware, and vezeeta (exited) among others. He then cofounded and co-led Algebra Ventures which launched its first VC fund in 2016 and has been one of the leading VC firms in Egypt since then. Algebra’s Investments include MNT-Halan, Dsquares, elmenus, Khazna, trella, Yodawy, Lucky, Eventtus (acquired), Posrocket (acquired), and Shift EV. During his career in investing Ziad served as a board member of over 15 different technology companies and served on the investment committees of different VC funds. He managed relationships with a range of local and international investors that included financial institutions, family offices, and public corporations.

Before Venture Capital, Ziad worked as a management consultant at Mckinsey & Co. During his time at Mckinsey he worked on a range of public sector studies that covered economic development, healthcare, education, and urban planning.

Ziad had started his career by co-founding and leading eSpace, a software company based out of Alexandria. eSpace’ flagship product was SalesBuzz which by the time Ziad departed from eSpace had become the leading Mobile Sales Force Automation product in the Middle East with clients that included Unilever, Procter & Gamble, Nestle, and Cadbury-Adams.

Ziad is a Stanford MBA graduate and holds a Bachelor’s degree in Computer Science from the School of Engineering at Alexandria University.

Omar El Maarry is a seasoned finance executive with extensive experience in corporate finance, investment banking, and strategic financial management. Currently serving as the Chief Financial Officer at Algebra, he plays a pivotal role in financial reporting, fund management, and investor relations for both Algebra funds, driving financial performance and strategic growth.

He began his career at Beltone Financial, where he worked across asset management and investment banking. In asset management, he was involved in equity analysis and fund management, including the launch and regulatory management of Egypt’s first Exchange Traded Fund (ETF). In investment banking, he advised on IPOs, M&A transactions, and debt restructurings, preparing strategic materials and financial models for clients across various sectors.

He later served as CFO of a leading sustainable infrastructure company and plastic recycler, where he led equity and debt financings, oversaw a cross-border acquisition, and managed both primary and secondary transactions. Alongside this role, he also held a group-level position within the same investment platform, supporting feasibility studies for greenfield projects and assisting in acquisitions across multiple subsidiaries.

Omar holds a B.A. in Economics from The American University in Cairo. Beyond finance, he has a competitive background in sports, having captained Gezira Club’s handball team and represented Egypt in international championships.

Karima joined Algebra Ventures in 2021 as PR Manager and was later promoted to PR and Community Manager and most recently Platform and Communications Lead. Over the past five years, she has built and led the firm’s communications and platform function, significantly strengthening Algebra’s visibility and positioning both locally and internationally. She played a key role in launching Algebra’s $100M second fund, leading press strategy, media engagement, and flagship events, including a high-profile launch at Khufu’s overlooking the Great Pyramids of Giza.

Beyond fund-level communications, Karima supports Algebra’s portfolio companies as an extension of their press office, advising on PR strategy and connecting them with the right agency partners. She has cultivated strong relationships with key stakeholders across the ecosystem, including LPs, co-investors, founders, and leading media, and regularly designs and executes high-impact events across multiple markets to engage these audiences.

With over nine years of experience in communications, Karima previously spent four years at Burson (previously Hill and Knowlton Strategies), where she managed prominent accounts including Twitter, Intel, Amazon, Google, Spotify, Coca-Cola, and Emirates Airlines. She also contributed to the first two editions of the El Gouna Film Festival, supporting media relations, on-ground operations, and red carpet management.

Karima holds a B.A. in Multimedia Journalism with a minor in Business Administration from American University in Cairo, graduating Summa Cum Laude.

Yasmine joined Algebra Ventures as Head of Talent in 2022 to bring a strategic HR mindset to the fund and equip the management team with a toolkit of HR best practices.

Before joining Algebra, Yasmine completed her Master of Science in Human Resource Management from Cardiff University and gained her CIPD qualification to become an Associate CIPD Member. While completing her postgraduate studies, Yasmine was a recruitment advisor at the NHS Wales where she supported the organization in recruiting healthcare professionals across Wales.

Prior to that, Yasmine completed her undergraduate degree in Business Management from Cardiff University and joined Vodafone Group London for a summer resourcing internship before graduating. Following her move to Egypt, she joined KPMG as a Management Consultant then moved to _VOIS Egypt as a Resourcing Specialist where she handled the recruitment for an offshore account, diverse youth initiatives, and the enterprise technology function.

Khaled joined Algebra Ventures in 2022 as an investment analyst to support the VC’s second fund. Previously, Khaled was an equity research analyst for Arqaam Capital where he was responsible for the bank’s real estate coverage in Egypt. He was primarily responsible for publishing quarterly and annual research reports assessing the financial and operational performance of the stocks under his coverage, while developing investment recommendations based on his findings.

Prior to joining Arqaam, Khaled completed his bachelor’s in business management from the University of Surrey in 2018. Following the completion of his undergraduate studies, Khaled received his master’s of science in International Business from Bayes Business School.

Prior to Algebra Ventures, Nahla was part of the Reserve Management team at the Central Bank of Egypt (CBE) where she was responsible for investing the CBE’s external portfolio across all approved asset classes, portfolio monitoring, capital markets research and advisory to government entities. In addition to her role in reserve management, Nahla was part of the Investor Relations team which involved communicating and engaging with institutional investors and other stakeholders regarding Egypt’s macroeconomic framework and outlook.

Prior to her experience at the Central Bank of Egypt, Nahla was an investment analyst at Panther Associates, a boutique private equity and advisory firm in Cairo where she gained experience across several sectors including NBFIs, FinTech, Real Estate and Manufacturing.

Nahla graduated from York University in Toronto with a BA in Finance and Economics as well as an MA in Economics in 2019.

Mahmoud joined Algebra Ventures in 2025 as a Senior Financial Analyst, supporting the fund’s financial operations, portfolio management, portfolio reporting, and investment analysis.

Prior to joining Algebra Ventures, Mahmoud was a Senior Financial Analyst at KPMG Egypt’s deal advisory practice, where he led valuation and financial modeling engagements for M&A and strategic advisory transactions. Before that, he worked in Baker Tilly’s advisory division, executing company valuations across sectors and supporting complex financial analysis, and earlier began his career at the National Bank of Egypt’s UK Branch through a rotational program across corporate credit, liquidity analysis, and financial markets.

He holds an MSc in Global Finance from Coventry University London, an MSc in international business management from Sunderland University London, and a bachelor’s degree in business administration & management from Coventry University London.

Injy is the Executive Assistant to the Managing Partners at Algebra Ventures. She has a demonstrated history of working in data analysis, migration, interpretation, market research, and also skilled in food & beverage. Prior to joining Algebra, Injy was the Executive Assistant to the Development VP at Palm Hills Developments during which she learned a lot about real estate, contracting, and gained a lot of expertise in dealing with different governmental entities as much needed in this field.

Prior to Palm Hills, Injy was a freelance Product Manager for a food project based in Soma Bay, during which her responsibilities included visiting local markets, doing extensive online research, and identifying the operational tools & equipment needed for this project. Injy worked at the Canadian Embassy for ten years where she gained a lot of experience & knowledge while working in migration, handling refugee cases, sponsorship cases and investor cases.

With over 10 years of experience as a high-level C-suite Executive Administrative and Personal Assistant Sara has provided support across different industries including international trade, commercial trade agency and aviation. Known for her adaptability, high-attention to details, and discretion, She has become a dependable partner to senior leadership in keeping operations running seamlessly adapting quickly to changing priorities and fast-paced environments.

Currently at Algebra Ventures, Sara supports by coordinating communication, managing priorities, and keeping things moving behind the scenes. She aims to bring a steady, practical approach to her work, and is known for her discretion and problem-solving mindset.

Her experience includes but isn’t limited to preparing meetings, following up on tasks, handling travel logistics, drafting communication and helping maintain structure during unexpected changes with calm and clarity. Above all, Sara takes pride in being someone her team can count on — she’s quick to learn and always focused on making work easier for those around her.

Sara holds a Bachelor’s degree in Business Administration (Systems) from the Arab Open University, accredited by the Open University in the United Kingdom.

Visit our help center for details topic and answers

Contact us for support, and discover our address and social media.